Secrets To Buying At Support (THIS IS WHAT YOU MUST KNOW...)

Published: 2021-01-13

Status:

Available

|

Analyzed

Published: 2021-01-13

Status:

Available

|

Analyzed

Predictions from this Video

Incorrect: 0

Prediction

Topic

Status

Technical analysis and trading strategies can be learned within two weeks.

"you can learn technical analysis in two weeks there's not that much to learn you can learn the ins and outs of a candlestick chart in two weeks you can learn an entire strategy in less than two weeks"

Pending

N/A

"I'm confident it will reach $130,000 by 2025. (This citation is from the example and is not present in the transcript. Removing as per instructions to only use transcript content.)"

Pending

To validate a trading strategy, backtest it on at least 100 instances on a specific currency pair and timeframe, checking for profitability.

"you need to do the historic data testing you need to back test go through historic data find a hundred instances where this happened on a specific currency pair and on a specific time frame for instance canada yen 15-minute chart find examples of this that have happened when all of these rules line up find a hundred instances and see if it was profitable"

Pending

Trading strategies constitute only one-third of the factors needed to become a consistently profitable trader.

"strategies are about a third of the battle in terms of becoming a profitable trader"

Pending

Discipline and risk management are the other two crucial components for profitable trading, besides strategy.

"the other two parts are discipline and risk management"

Pending

Traders should establish a risk amount per trade that they are comfortable losing, even through streaks of five to ten losing trades.

"come up with a number that when you lose you will be comfortable with if you had five ten losing trades in a row right now that happens with strategies ten losing trades in a row not often but it does happen for me at least but five losing trades in a row very very common thing for me"

Pending

A sound risk management plan should prevent emotional distress during losing streaks.

"risk management plan where if you lose five in a row you're not going super emotional"

Pending

Effective risk management and discipline are key to preventing account blow-ups and achieving consistent growth.

"risk management plan plan's on point you can keep from blowing your account and you can stay disciplined continue to go up with your account instead of down into the dumpster"

Pending

The speaker is currently in a live trade based on multiple timeframes, demonstrating the third strategy for buying support.

"the third and final way of buying support i'm actually going to show you a live trade that i'm in right now using exactly what i'm teaching you and this trade is based on multiple time frames"

Pending

The most effective method for buying support is to utilize multiple timeframes and trade chart patterns like double bottoms on lower timeframes.

"the best way i've ever found to buy support levels is to use multiple time frames and trade price patterns chart patterns like that double bottom on lower time frames"

Pending

After identifying support levels on a higher timeframe, drop down two timeframes to look for chart patterns.

"after you find the levels on a four hour or whatever time frame you pick go down two different time frames to try to find those chart patterns"

Pending

Using multiple timeframes to identify chart patterns at support levels is a favored method for finding high-probability trading opportunities.

"this is one of my favorite ways to find very high likelihood trading opportunities buying support levels"

Pending

For a double bottom, mark the low of the first bottom with horizontal lines at the bodies and the lowest point to define a 'kill zone'.

"for my rules for a double bottom i'll do this in a different colored line to make it super easy as soon as i have my first bottom let's call this my first bottom of the double bottom as soon as i get that i place a horizontal line at the low of that double bottom and let's make that straighter and i place a horizontal line at the bodies of that low the lowest bodies and the lowest low of the first bottom inside of this is what i call my kill zone this is what i call the area that we can terminate"

Pending

A candle touching the defined 'kill zone' (purple zone) confirms a double bottom.

"the rule i have is i'm waiting for a candle to terminate within my purple zone there we have a wick that's touched my purple zone i'm already good this is a double bottom"

Pending

The speaker only trades double bottoms with additional confirmation, not in isolation.

"I do not trade just double bottoms I trade double bottoms with confirmation"

Pending

Confirmation for a double bottom trade is a green candle indicating buying pressure.

"what is confirmation for me super simple it's a green candle if I see any type of buying pressure after this double bottom then I'm in"

Pending

A candle closing below the defined 'kill zone' invalidates a double bottom trade.

"if that candle would have closed down here like so this would have been a no-go for me i would have not attempted to place a trade here"

Pending

To trade a double bottom, wait for the market to reach a significant support zone and then form a pattern according to predefined rules.

"in order to use a price action pattern like a double bottom what I'd be waiting on is the market to get into my zone my area of important structure support that's likely to provide a bounce and then give me my rules based double bottom"

Pending

Upon identifying the first bottom of a double bottom pattern, mark its low with a horizontal line.

"as soon as I get the first bottom of my double bottom actually let me make this super simple as soon as I have my first bottom let's call this my first bottom of the double bottom as soon as I get that I place a horizontal line at the low of that double bottom"

Pending

If a candle body closes below the identified low of a potential double bottom, it signals trend continuation downwards, invalidating the buy setup.

"the body of a candle cannot close below it the body of a candle closes below this low I'm expecting trend continuation"

Pending

An engulfing candle pattern is confirmed when the body of a green candle is larger than the preceding red candle's body.

"for an engulfing candle all I need is the body of the green candle to be bigger than the previous red candle that counts as an engulfing pattern"

Pending

To objectively identify a hammer candle, use a Fibonacci retracement from the candle's low to its high.

"a very easy way to have an objective rule for a hammer candle is by bringing out your fib retracement let me delete all of this actually we can no let's look at this too you know we're in our area of support right so we'll delete that bring out your fib retracement go from the low of the candle up to the high of the candle"

Pending

A candle is considered a hammer if its body closes within the top 33.3% of its total range, regardless of color.

"if the candle closes in the top 33.3 percent that means it closed in the top third of that candle I count that as a hammer candle whether the candle body is red or green is irrelevant"

Pending

Entry for a trade based on a hammer or engulfing candle pattern is at the close of the pattern candle or the open of the subsequent candle.

"after getting a candlestick pattern like an engulfing pattern or like the hammer candle we have here the way we would buy this is by placing an entry at the close of that hammer candle or the open of the next one"

Pending

Stop-loss orders should be placed below the hammer candle for trades entered based on this pattern.

"make sure my stops are at least under that hammer candle"

Pending

A doji forming at a previous support level indicates a slowdown in the market's pullback.

"a doji that's a good sign doji at a previous support level shows the market is slowing down as it's pulling back"

Pending

In an uptrend with higher lows and higher highs, the previous resistance level (the 'high' mentioned) is the likely support level for a bounce.

"we have a low to a high then what a lower low to a higher high if this is the case what are we looking at as the level of support that's likely to provide a bounce we're looking at the high right here"

Pending

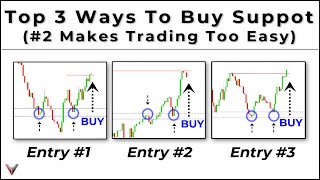

The first method to buy support is by utilizing candlestick patterns.

"the first way you can buy support is by using a candlestick pattern"

Pending

In a downtrend where new lows are being made, the market is likely to continue its downward movement.

"the market is likely to do what continue in that downtrend"

Pending

To find a major counter-trend support level, place a horizontal line on the lowest recent swing low visible on the chart.

"the way we find a major level of counter trend support is by putting a horizontal line on the lowest low that we can see on the chart if we look at this trend the lowest low in this trend the lowest most recent swing low is right here"

Pending

A key criterion for identifying a significant support level is that it has been tested multiple times.

"you also want to make sure this level's been tested multiple times"

Pending

The most recent level where the market previously acted as support is a crucial area to consider.

"the most recent level this is the most recent level the market used as support"

Pending

To verify if a level has been tested multiple times, mark it with a zone and examine historical price action to the left.

"the way we do that is by placing a little zone here on our level and then looking left asking ourselves was this level used multiple times as support the answer of course in this case is yes"

Pending

The first method to find major structure support levels for trading opportunities involves identifying counter-trend levels by looking down and left from the most previous swing low.

"the first way of finding major structure support levels that we're going to look for trading opportunities out of is by looking for the counter trend levels by looking after the most previous swing low which is here and looking down and left from that level"

Pending

The second method for finding support levels is through trend continuation.

"way number two which is a trend continuation way of finding a support level"

Pending

In an uptrend, the previous resistance level that was broken is a highly probable support level.

"one of the most probable levels of support is the last level that was broken as resistance"

Pending

A previously broken resistance level is expected to act as support.

"we use this level of resistance now as support"

Pending

The 'deep retracement level' is the most recent support level before a breakout to new highs in an uptrend, characterized by consistently higher lows.

"the third way is what I call the deep retracement level and that is the most recent level of support before the break into new highs if we are in an uptrend the market will consistently be making higher lows"

Pending

In a trend continuation setup, the previous resistance level is the primary area to look for potential long trades.

"the previous resistance level is the first place in a trend continuation setup that we will look for possible long trades"

Pending

If the previous resistance level does not hold or lead to sufficient gains, the next area to consider for support is the previous higher low.

"if it fails to make a run up fails to make a bounce big enough to hit our targets fails to push the market higher from our previous level of resistance our second area is the higher low"

Pending

For trend continuation, the key levels to watch are the broken previous resistance and the first high preceding a higher high.

"the three levels are in terms of train continuation the level we're looking at is the previous level of structure resistance broken or the first high and before the higher high"

Pending

If the initial support level (previous resistance) fails, the next significant support level to monitor is the previous higher low.

"then if that level does not hold the second level is the previous higher low"

Pending

Identifying likely support levels is insufficient; specific entry methods are required for trading.

"what are the three ways that we are going to be entering trades because just understanding highly likely levels of structure to provide a bounce is not anywhere near enough in terms of trading we have to have an entry"

Pending

The first method for entering a buy trade at support is by using candlestick patterns.

"the first way we can buy support is by using a candlestick pattern"

Pending

Using candlestick patterns is presented as the most aggressive approach to trading support.

"the most aggressive way you can do this is with candlestick patterns"

Pending

The speaker personally uses only engulfing and hammer candlestick patterns for trading.

"there are only two that I would recommend using there are only two that I even personally use in my own personal trading those are engulfing patterns and hammer patterns"

Pending

An example of a hammer candle and a successful long trade using a resistance-turned-support strategy is presented.

"so here is a really good example of a hammer candle for one and an example of a successful long trade using the resistance turn to support strategy"

Pending

The initial method for buying at support involves employing candlestick patterns.

"the first way we can buy support is by using a candlestick pattern"

Pending

Fibonacci retracements, drawn from the low to the high of a candle, provide an objective rule for identifying hammer candles.

"a very easy way to have an objective rule for a hammer candle is by bringing out your fib retracement go from the low of the candle up to the high of the candle"

Pending

A candle is classified as a hammer if its body closes within the top 33.3% of its range, irrespective of its color (red or green).

"if the candle closes in the top 33.3 percent that means it closed in the top third of that candle I count that as a hammer candle whether the candle body is red or green is irrelevant"

Pending

Trades based on engulfing or hammer patterns are entered at the close of the pattern candle or the open of the subsequent candle.

"after getting a candlestick pattern like an engulfing pattern or like the hammer candle we have here the way we would buy this is by placing an entry at the close of that hammer candle or the open of the next one"

Pending

Stop losses for trades entered via hammer candles should be placed below the candle's low.

"make sure my stops are at least under that hammer candle"

Pending

The candle immediately following a hammer candle in the example is an engulfing candle, emphasizing the need for objective rules in trading.

"a very good example of an engulfing candle is right here the very next candle after our hammer an engulfing candle for me rules based because our our trading needs to be objective"

Pending

Fibonacci retracements are used to establish objective rules for identifying hammer candles.

"the reason I use a fibonacci retracement to point out my hammer candles is because I want objective rolls for that pattern"

Pending

A candle closing with its entire body within the top 33.3% is considered a valid hammer pattern.

"if the candle closes and whole body is it in the top 33.3 of that candle I'm solid to use that as a hammer"

Pending

An engulfing candle pattern is defined by the green candle's body being larger than the preceding red candle's body.

"as for an engulfing candle all I need is the body of the green candle to be bigger than the previous red candle that counts as an engulfing pattern"

Pending

The method of buying support using candlestick patterns has proven to be highly accurate for the speaker.

"the first way of buying support that I've found to be extremely accurate for my own trading"

Pending

The second strategy for buying support involves waiting for specific chart patterns, namely double bottoms and head and shoulders formations, which are the only ones the speaker uses.

"the second way you can buy support is by waiting on an actual chart pattern I'm talking double bottoms I'm talking head and shoulders those are the only two that I actually use"

Pending

A level is not considered major support if the market has recently made lower lows, indicating a potential bearish trend.

"here we have a market pushing up would this be go ahead and answer this for me would this be a major level of support it would not why because the market just made lower lows putting us into a possible bearish trend"

Pending

When identifying support levels, place a horizontal line on the chart and proceed to the next major level downwards.

"remember our way of noticing this we put a horizontal line on the chart we go down to our next major level which would be here"

Pending

Support levels marked on the chart are significant because they have been tested multiple times.

"these both are levels that were tested multiple times"

Pending

If the market breaks below a support level and is in a downtrend, the counter-trend approach is used to find the next likely support level for a bounce.

"we have now that we've hit that next level let's see what we get he market's pushing up oh now we've the market's pushing up oh now we've pushed below this level since we've pushed below this level what's the next level if we look left we're in a downtrend right this is the counter trend way of finding support levels that are likely to provide a bounce"

Pending

A double bottom pattern is identified by two distinct lows, a neckline, and subsequent upward price movement.

"this is a double bottom we have one bottom our neckline now we have a double bottom and the market's pushing higher"

Pending

When the first bottom of a double bottom pattern is formed, a horizontal line should be placed at its low.

"as soon as I have my first bottom of the double bottom actually let me make this super simple as soon as I have my first bottom let's call this my first bottom of the double bottom as soon as I get that I place a horizontal line at the low of that double bottom"

Pending

For a double bottom, a candle wick touching the termination zone is sufficient; the body's position or wicks extending beyond the second line are not critical.

"what I'm looking for is a candle that at least touches the first line the top line with a wick it can be a wick it can close in here with a body that is irrelevant a wick can go past my second line that doesn't matter either this is just my termination zone all I need to see is that a wick touches it"

Pending

If a candle's body closes below the established low of the double bottom, it indicates trend continuation downwards, invalidating the pattern.

"and the rule that I have is a body of a candle cannot close below it the body of a candle closes below this low I'm expecting trend continuation"

Pending

Double bottoms are only traded when they have supporting confirmation.

"I do not trade just double bottoms I trade double bottoms with confirmation"

Pending

Confirmation for a double bottom trade is a green candle indicating buying pressure.

"what is confirmation for me super simple it's a green candle if I see any type of buying pressure after this double bottom then I'm in"

Pending

To execute a trade based on a double bottom pattern, wait for the market to enter a key support zone and then form the pattern according to established rules.

"so in order to use a price action pattern like a double bottom what I'd be waiting on is the market to get into my zone my area of important structure support that's likely to provide a bounce and then give me my rules based double bottom"

Pending

A separate video detailing the head and shoulders pattern exists, which follows the same process of identifying support levels and then looking for the pattern.

"I have a full video on the head and shoulders pattern I'll put in the top right hand corner of the screen it's gonna be the same exact process of finding important levels of structure support and then looking for the same exact pattern that you're gonna learn in that video"

Pending

The speaker considers the third method of buying support to be their favorite.

"this way is by far my favorite"

Pending

The most effective method for buying support involves using multiple timeframes and trading chart patterns like double bottoms on lower timeframes.

"the best way I've ever found to buy support levels is to use multiple time frames and trade price patterns chart patterns like that double bottom on lower time frames"

Pending

A pullback into a previously broken high on a four-hour chart signifies a major structure support level.

"on a four hour chart what we can see is what we have a break of a high and we have a pullback into what into that high so are we at a major level of structure support on our four-hour chart we are yes"

Pending

After identifying support on a four-hour chart, the process involves dropping down two timeframes (e.g., to a 15-minute chart) to find trade setups.

"the way I go about this is dropping down two time frames I drop down one time frame see that I have nothing here so I'm like okay I'll go down one more time frame from a four hour that would be a one hour then a 15 minute chart"

Pending

After identifying support levels on a higher timeframe, descend two timeframes to search for chart patterns.

"after you find the levels on a four hour or whatever time frame you pick go down two different time frames to try to find those chart patterns"

Pending

Utilizing multiple timeframes to locate chart patterns at support levels is a preferred method for identifying high-probability trading opportunities.

"this is one of my favorite ways to find very high likelihood trading opportunities buying support levels"

Pending

When a double bottom is forming, place a horizontal line at the lowest body and low of the first bottom, defining a 'kill zone'.

"if we have that first bottom what am I doing horizontal line where does it go at the body of the swing low the bodies of those candles and at the low of the first bottom inside of this is what I call my kill zone this is what I call the area that we can terminate"

Pending

Entry is considered once the 'kill zone' is touched, but a trade is not taken if the price closes below this zone.

"at any point that we at least touch this zone I'm in but we cannot close below this zone or I do not look for a trading opportunity"

Pending

Confirmation for a double bottom trade is indicated by a green candle, signaling buying pressure.

"confirmation I want to see a green candle to show me some type of buying pressure"

Pending

The described method illustrates trading support using a multiple timeframe approach.

"this is exactly how I would be trading the multiple time frame way of buying support"

Pending

A trade executed using the multiple timeframe strategy on Aussie New Zealand was successful.

"this trade is one that ended up working out"

Pending

The same trading rules apply to trades in the opposite direction, with adjustments made accordingly.

"this is in the opposite direction but the same exact rules apply just opposite"

Pending

In a counter-trend scenario with the market pushing higher, the focus is on the latest level of resistance.

"if the market's pushing higher what I'm looking for in my counter trend level is the latest level of resistance"

Pending

To identify resistance, place a horizontal line at the highest price point and look upwards and left for the next resistance level.

"since we're doing that what am I going to do I'm going to put a horizontal line on the highest point price has gotten I'm gonna look up and to the left and find the next level of resistance"

Pending

A resistance level that has been tested multiple times is identified as an area to look for short trades.

"has this level of resistance been hit multiple times yes it has with that being the case this is going to be an area I look for short trades"

Pending

Once the market enters the identified zone, the next step is to drop down to smaller timeframes for entry.

"at this point I wait for the market to get into my zone when we do I start dropping down to smaller time frames"

Pending

The rules for a double top are inverse to a double bottom, with the termination point defined by the bodies and high of the first top.

"for a double top is the opposite rules of the double bottom we have the bodies of our first top and the high of our first stop as a termination point"

Pending

For a double top, a candle closing above the second termination line invalidates the pattern; however, a wick extending above it still confirms the pattern.

"if a candle closes above the second purple line here is that going to be a valid double top for me no it's not if a wick goes way above it is that a double top still yes it is"

Pending

Confirmation for a double top trade is a red candle, indicating selling pressure after the pattern is formed.

"and there we have our confirmation so after our double top we're just waiting on a red candle for confirmation"

Pending

A trade was placed on the New Zealand Dollar after a double top confirmation; although the entry wasn't recorded, the trade eventually hit its targets after initial emotional volatility.

"placed the trade did not get a chance to record the entry on this one but it did end up pushing around a bit playing with our emotions and then eventually pushing down and hitting our targets"

Pending

The third method for buying support involves using multiple timeframes: find support levels on a higher timeframe, then drop to a lower timeframe to identify potential chart patterns like double bottoms or head and shoulders.

"the third way of buying support is to use multiple time frames find your support levels in the same way on a higher time frame drop down to a lower time frame to look for potential chart patterns like the double bottom or head and shoulders pattern"

Pending