3 Technical Analysis Factors That Hit HARD In Forex, Crypto, and Stocks..(Don't Trade Without These)

Published: 2022-06-23

Status:

Available

|

Analyzed

Published: 2022-06-23

Status:

Available

|

Analyzed

Predictions from this Video

Incorrect: 0

Prediction

Topic

Status

The speaker achieved a 7:1 reward to risk ratio on a New Zealand Dollar trade using their trading system.

"how I place the trade you see on the screen that's currently up about a seven to one reward to risk ratio on the new zealand dollar"

Pending

The speaker used the same trading system to achieve a 2.7:1 reward to risk ratio on an Aussie New Zealand trade.

"it's also the same exact system I used in order to place this trade here on the aussie new zealand that's currently up around a 2.71 reward to risk ratio"

Pending

A New Zealand Dollar trade, after being stopped out with a trailing stop, resulted in a 5.5:1 reward to risk ratio.

"we ended up getting stopped out on our trailing stop and making about a 5.5 to one on this trade"

Pending

The speaker entered a New Zealand Dollar trade after observing a double top pattern with selling pressure.

"we have price pushing up one top neckline double top got some selling pressure at that double top decided to go ahead and place that trade"

Pending

The speaker had previously signaled a bearish outlook and potential sell opportunities for the Aussie New Zealand pair in their pro trader report.

"I warned traders in the pro trader report that I was looking for sell opportunities in this area the week before"

Pending

The speaker realized approximately a 4.6:1 reward to risk ratio on their Aussie New Zealand trade.

"i ended up getting my profits off at around a 4.6 to 1 reward to risk ratio here on the aussie new zealand"

Pending

The speaker's trading method, using three technical factors, has provided a significant edge and generated substantial profits over their career.

"the method i'm going to teach you in this video that only uses three very simple technical factors is something that has provided a massive edge over markets for me and made me a ton of money throughout my trading career"

Pending

The speaker's trading method relies on three simple technical factors that can be explained quickly.

"these three technical factors are so simple that I can explain them in five minutes"

Pending

Adding too many technical factors to a trading strategy reduces trade frequency, even if accuracy increases.

"if you add a lot of technical factors to a system or strategy you're trading you're going to decrease the frequency of trades that you can get to the point that if you're looking for let's say five to ten different technical factors on a trade that trade may be very accurate but you may only get three trades a year"

Pending

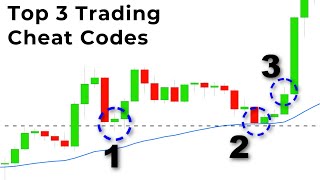

The speaker's preferred trading strategy for the past decade involves three key factors: higher time frame major structure levels, higher time frame indicator confluence (HTFIC), and a lower time frame entry.

"the three technical factors that are my favorite and that I have used for the past decade of my trading career in order to take advantage of the market are one a higher time frame major level of structure two htf ic which is higher time frame indicator confluence and number three is an entry on a lower time frame"

Pending

Approximately 75% of the speaker's lower time frame trade entries are based on double tops or double bottoms.

"75 of the time the entry I'm using on a lower time frame is going to be a double top or a double bottom"

Pending

Becoming a profitable trader requires more than just watching a short video; it's not a quick path to riches.

"becoming a profitable trader will never be as easy as watching a 20-minute video and then going and trying to make as much money as possible with what you had just learned in that video"

Pending

Traders who are not consistently profitable should shift their focus away from making money and towards learning how to trade.

"at the beginning of your trading career or even if you've been trading for a long time but you are not profitable you need to stop worrying about making money"

Pending

The primary goal for beginner traders, instead of profit, should be to learn the mechanics and skills of trading.

"instead of focusing on making money as a beginner you should focus on learning how to trade"

Pending

The trading method discussed in the video is applicable across various financial markets, including stocks, crypto, and forex.

"the method I taught you works in all financial markets stocks crypto forex whatever you trade"

Pending

Traders should practice and perfect any trading system through extensive backtesting and forward testing.

"you need to go practice and perfect this system through the process of back testing and forward testing over a large sample size of trades"

Pending

Consistent backtesting and forward testing of a trading strategy builds significant confidence for the trader.

"doing this back testing forward testing practicing with the strategy is going to give you an amazing amount of confidence"

Pending

Mastering risk management and trading psychology is a crucial step before trading live.

"you need to study up on risk management and trading psychology until you feel as though you've mastered those two things"

Pending

All necessary information to learn trading skills can be found for free on Google and YouTube.

"every bit of information you need in order to learn any skill of trading is available for you for free on either google or youtube"

Pending

A comprehensive trading plan should include trading times, entry strategies, risk management, and daily journaling.

"what times do I trade what times do I need to wake up to actually get by my computer and place trades what is the exact strategies reason for entry everything else that I'm trading around what is my risk management plan and I journal at the end of every day"

Pending

Consistent trading profits are the result of a large sample size of trades over time, not from individual lucky trades.

"these profits happen over time not from one lucky trade they are something that happen over a large sample size of trades"

Pending

Experiencing losing weeks or even months is normal in trading, as long as the overall year results in profitability.

"if you have a week where you lose money that's completely normal I've been through months where I lost money throughout that month but at the end of the year I've always came out profitable"

Pending